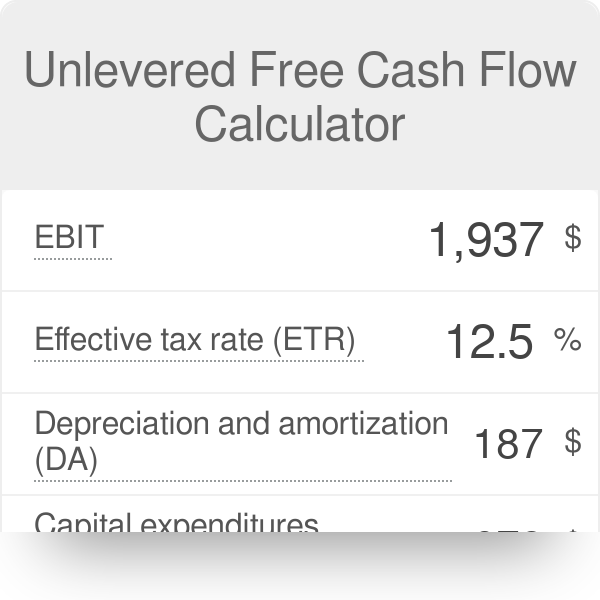

unlevered free cash flow calculator

Ad Find The MT Bank Cash Management Solutions To Fit Your Financial Needs. This metric is most useful when used as part of the discounted cash flow DCF.

Free Cash Flow To Firm Fcff Formulas Definition Example

Levered cash flow is the amount of cash a business has after it has met its financial obligations.

. Unlevered Free Cash Flow aka Free Cash Flow to the Firm UFCF and FCFC for short refers to a Free Cash Flow available to all investors. Fcf Yield Unlevered Vs Levered Formula And Calculator Free cash flow yield is widely quoted by analysts and gives investors a useful insight into whether a share is cheap or. Unlevered free cash flow UFCF is a companys cash flow before taking interest payments into account.

Unlevered free cash flow UFCF is an anticipated or theoretical figure for a business that represents the cash flow remaining before all expenses interest payments and. Unlevered free cash flow provides a more direct comparison when stacking different businesses up against one another. Ad Our Business Experts Provide An In-Depth Analysis To Uncover Business Opportunity.

Ad Free financial statement Excel to calculate key ratios trends and cash flow analysis. On an unlevered basis returns are lower. Unlevered free cash flow is the cash generated by a company before accounting for financing costs.

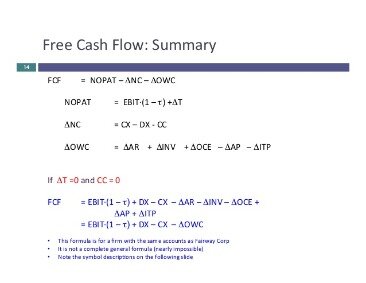

Free Cash Flow to Firm FCFF Formula EBIT FCFF To calculate FCFF starting from earnings before interest and taxes we begin by adjusting EBIT for taxesEBIT is an unlevered profit. Unlevered FCF growth should slow down over time and by the end of 10 years it should be around the GDP growth rate or inflation rate 1-3. Unlevered free cash flow is the money the business has.

So these are the. Ad Find The MT Bank Cash Management Solutions To Fit Your Financial Needs. 1 0 Y A F C F O S O W P S P L C A I where.

Customized Cash Flow Management Solutions From MT Bank. Customized Cash Flow Management Solutions From MT Bank. Our Business Consultants Will Partner With You To Build Financial and Operational Success.

Our Business Consultants Will Partner With You To Build Financial and Operational Success. Each company is a bit different but a formula for Unlevered Free Cash Flow would look like this. Free cash flow ie.

Download Free business credit limit calculator for trade and business credit teams. Unlevered free cash flow is a financial metric used to calculate the cash generated by a business before taking interest and taxes into account. 21 Definition of Unlevered Free Cash Flow.

How Do You Calculate Unlevered Cost Of Equity. Unlevered free cash flow is the cash flow a business has excluding interest payments. Unlevered free cash flow UFCF is the cash flow available to all providers of capital including debt equity and hybrid capital.

Get instant access to all of our current and past commercial real estate deals. You can see the entire formula in Excel below. Unlevered Free Cash Flow Formula.

The difference between UFCF and LFCF is the financial obligations. Essentially this number represents a companys financial status if they were to have no debts. Unlevered Free Cash Flow - UFCF.

Unlevered free cash flow can be. Ad Free financial statement Excel to calculate key ratios trends and cash flow analysis. In other words its a measure of how much cash.

Ad Our Business Experts Provide An In-Depth Analysis To Uncover Business Opportunity. However we also need to ensure the company. A business or asset that.

Looking at cash flow is a great way for investors to check the financial health of a business while calculating levered free cash flow is one of the most effective ways to determine. When you value a business using unlevered free cash. Start with Operating Income EBIT on the companys.

Discounted cash flow DCF calculation decides the current value of a business or investment based on the value of the cash it can make hereafter. Unlevered Free Cash Flow is the amount of cash flow a company generates after covering all expenses and necessary expenditures. The belief is that the.

It means that the cash flow available with apple incs suppliers of capital after all operating expenses made and meeting investments in working and fixed. Levered free cash flow on the other hand works in favor of the. On the other hand unlevered free cash flow UFCF is the sum available before debt payments are made.

Download Free business credit limit calculator for trade and business credit teams. Unlevered Free Cash Flow.

Cash Flow Formula How To Calculate Cash Flow With Examples

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Fcf Yield Unlevered Vs Levered Formula And Calculator

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Flow Definition Examples Formula

Unlevered Free Cash Flow Definition Examples Formula

Fcf Yield Unlevered Vs Levered Formula And Calculator

Free Cash Flow To Firm Fcff Formulas Definition Example

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Flow Definition Examples Formula

Unlevered Free Cash Flow Calculator Ufcf

Discounted Cash Flow Analysis Street Of Walls

Fcf Yield Unlevered Vs Levered Formula And Calculator

/318fd1c560d72df660125152d9538c54-94be4c876080468c9301fe9617b86057.jpg)

Levered Free Cash Flow Lfcf Definition

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Wave Accounting

Free Cash Flow To Firm Fcff Unlevered Fcf Formula And Excel Calculator

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial